Maximum 401k Contribution 2025 With Catch Up Period

Maximum 401k Contribution 2025 With Catch Up Period - 401k Limits 2025 Catch Up Lissy Phyllys, Use our calculator to estimate your future balance. 401k Catch Up Contribution Limit 2025 Ailis Arluene, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

401k Limits 2025 Catch Up Lissy Phyllys, Use our calculator to estimate your future balance.

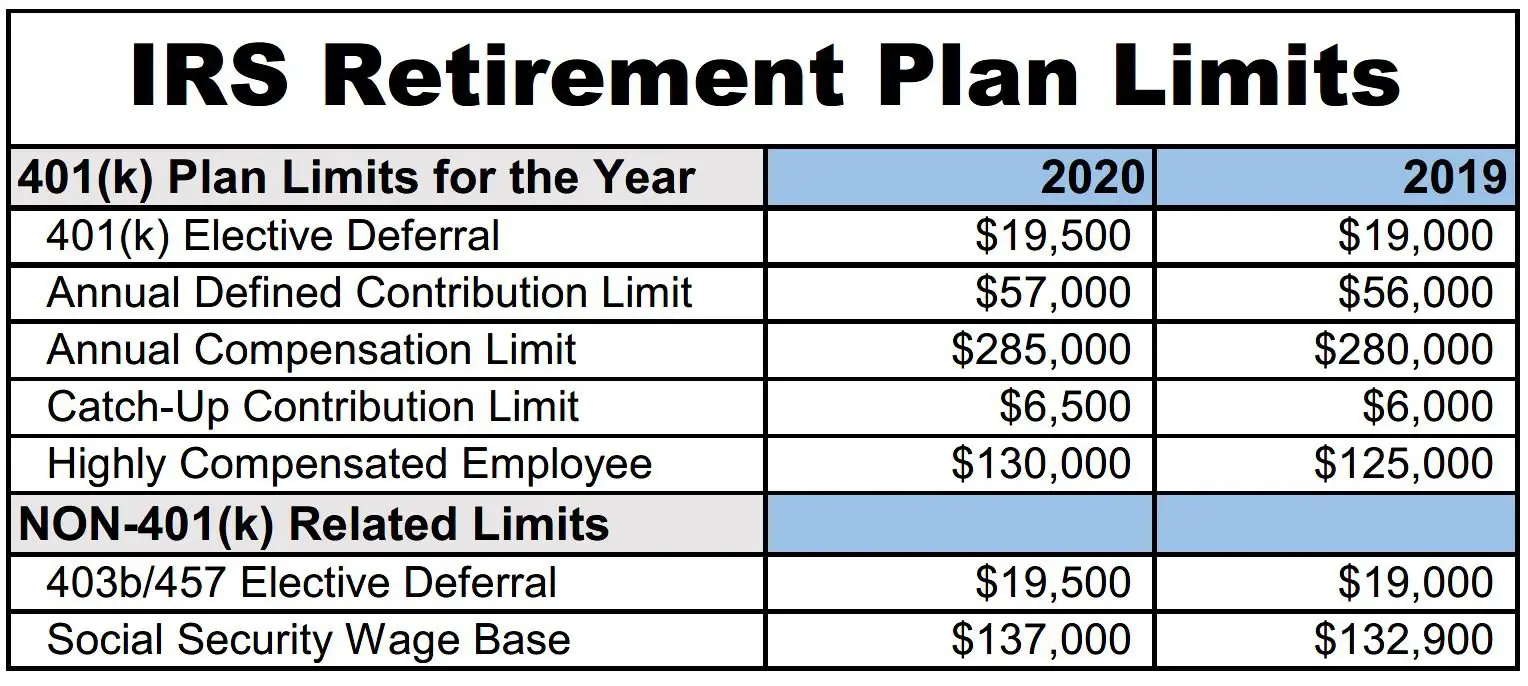

401k Contribution Limits 2025 Catch Up Total Robby Christie, The limit on employer and employee contributions is $69,000.

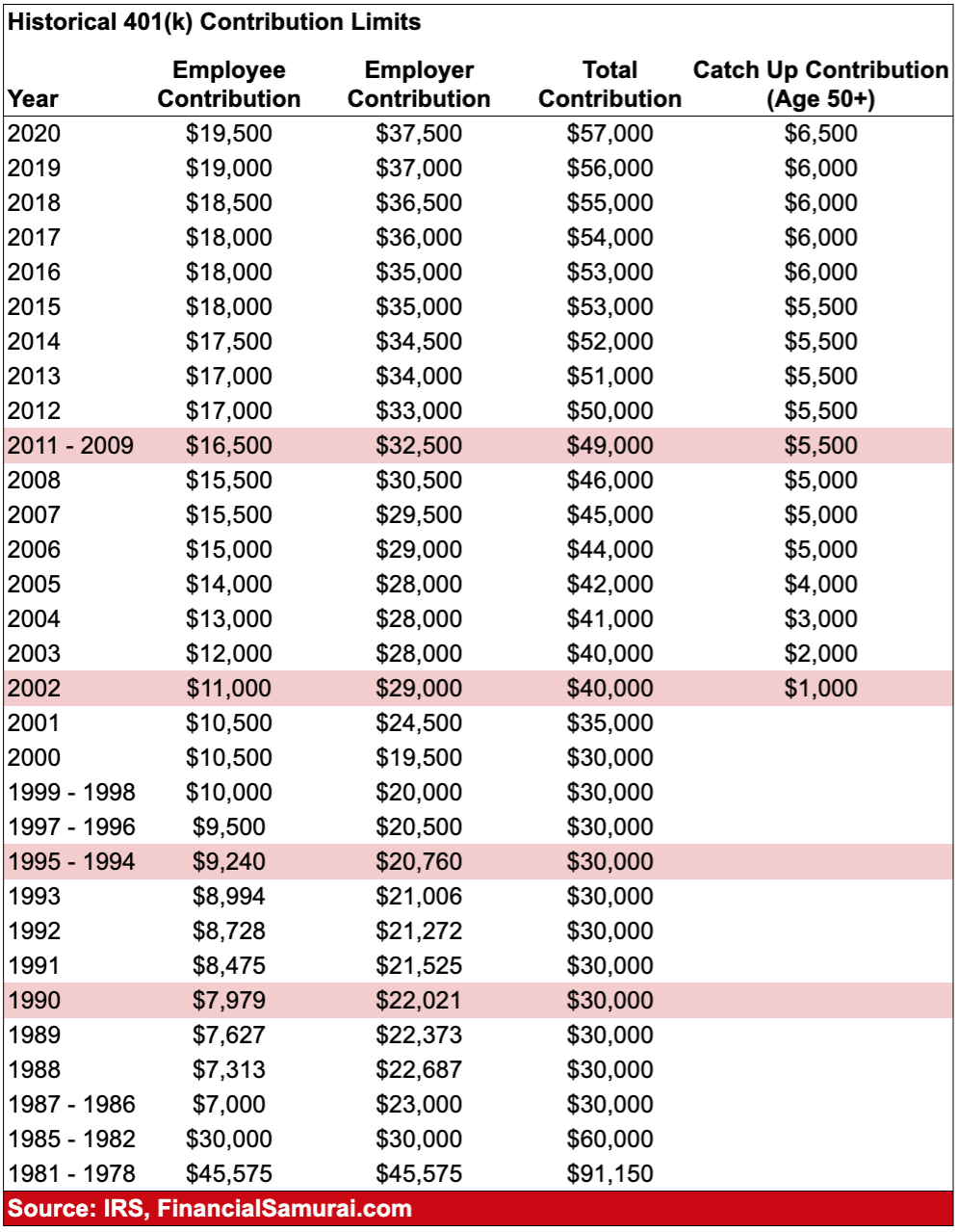

The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025. In 2025, the maximum annual contribution allowed is $30,000 (the $22,500.

Max 401k Contribution 2025 Over 50 Catch Up Rasia Catherin, Use our calculator to estimate your future balance.

401k Maximum Contribution 2025 Plus Catch Up Calculator Wynny Roxane, What is the new 401(k) contribution limit for 2025?

Maximum 401k Contribution 2025 With Catch Up Period. Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. It is $3,500 for simple 401(k).

Maximum 401k Contribution 2025 With Catch Up Gael Sallyann, Known as the 402(g) limit in the internal revenue code (or irc), individuals can contribute up to $20,500 between their traditional and roth 401(k) accounts in 2022.

Max 401k Contribution With Catch Up 2025 Alia Louise, Those 50 and older will be able to.

401k Maximum Contribution 2025 Plus Catch Up Age Jamima Constantine, If you're age 50 or.

401k Contribution Limits 2025 Catch Up Aggy Lonnie, The total maximum that can be tucked away in your 401(k) plan, including employer contributions and allocations of.

401k Max Contribution 2025 CatchUp Dacey Dorette, Known as the 402(g) limit in the internal revenue code (or irc), individuals can contribute up to $20,500 between their traditional and roth 401(k) accounts in 2022.